In this second of a two-part series of columns, George Washington law professor and economist Neil Buchanan explains how the German-led policy regime is likely to hurt not just Greece’s people but also people elsewhere in the world. Buchanan also describes how the arguments from German policymakers amounts to blaming the victims of the very policies they imposed upon the Greeks.

In this first of a two-part series of columns, George Washington law professor and economist Neil Buchanan explains why the situation in Greece is economically simple but politically nasty.

Chapman University law professor Ronald Rotunda calls for the end of the Export-Import Bank. Rotunda describes the Bank as a symbol of corporate welfare and government waste and highlights some of the ways in which the Bank is a drain on the American economy.

George Washington law professor and economist Neil Buchanan shares some good news about the living standards of recent retirees and argues that this news should serve as a reminder that there is a way to allow large numbers of people to go through their working lives, and then to live modest, comfortable retirements.

George Washington law professor and economist Neil Buchanan dissects former Florida governor Jeb Bush's statements regarding raising the age of retirement and Social Security.

George Washington law professor and economist Neil Buchanan analyzes the U.S. Supreme Court’s recent ruling in Comptroller of the Treasury of Maryland v. Wynne, a case dealing with the limitations on states’ tax systems implied by the dormant Commerce Clause.

George Washington law professor and economist Neil Buchanan describes how the paranoid style, first ascribed to politics by Richard J. Hofstadter in 1964, fits the current state of political affairs in the United States.

George Washington law professor and economist Neil Buchanan continues his discussion of the Republican assault on the Internal Revenue Service. Buchanan describes two aspects of a report recently published by the Republican staff of the House Ways & Means Committee that show Republicans are punishing IRS employees who have nothing to do with the supposed problems at the agency. Buchanan then goes on to describe what an honest attempt to reform the IRS would look like.

George Washington law professor and economist Neil Buchanan evaluates a recent report issued by the majority staff on the tax-writing Ways and Means Committee. Buchanan argues that the report illustrates Republicans’ attempts to claim not only that the IRS’s mistakes are entirely unconnected to its shrinking budget, but also that the IRS is consciously trying to make matters worse.

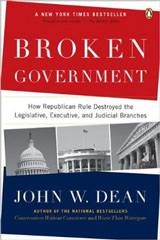

George Washington law professor Neil Buchanan describes Republicans’ persistent technique of undercutting, then blaming, the IRS for the nation’s tax woes.

George Washington law professor and economist Neil Buchanan discusses the debt ceiling law and explains why it must be repealed entirely.

Cornell University law professor Michael Dorf argues that modern constitutionalism supports economic libertarianism, due not only to judicial decisions but also the very structure of the Constitution. Dorf responds in part to a recent book review by Professor Suzanna Sherry, published in the March issue of the Harvard Law Review, that is highly critical of Professor Richard Epstein’s book The Classical Liberal Constitution.

George Washington law professor Neil Buchanan contends that Republicans’ use of the debt ceiling against President Obama in an attempt to achieve their policy goals could backfire and lead to an increase in taxes on the rich.

Chapman University law professor Ronald Rotunda discusses the comments by MIT economist and Obamacare consultant Jonathan Gruber and the principle of the wisdom of crowds.

George Washington law professor and economist Neil Buchanan argues that Republicans in Congress have effectively used budget issues to set a trap to impeach the President, but that they might well regret setting that trap.

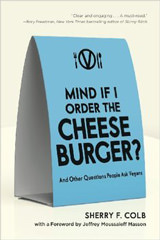

George Washington University law professor and economist Neil Buchanan explains why recent events detracting from the Affordable Care Act might lead to serious consideration of a single-payer health care system. Buchanan includes in his discussion the Supreme Court’s recent decision in NFIB v. Sebelius, a careless statement by economist Jonathan Gruber, and the upcoming challenge of it before the Supreme Court, King v. Burwell.

George Washington University law professor and economist Neil Buchanan argues that anti-government ideologues deny facts in order to support their theories of the economy.

George Washington law professor and economist Neil Buchanan argues that to effectively combat economic inequality, the government must employ both progressive taxation and progressive spending.

George Washington law professor and economist Neil Buchanan explains how the Ebola crisis highlights the dangerous consequences of demonizing the government.

Chapman University law professor Ronald Rotunda discusses the need for the Attorney General to appoint Special Counsel to investigate IRS misconduct. Rotunda argues that by appointing Special Counsel, the Attorney General can restore America’s faith in the nonpartisanship of the Internal Revenue Service.